Top Free Personal Finance Software to Unlock Your Financial Potential

Top Free Personal Finance Software to Unlock Your Financial Potential

Managing your finances effectively is the cornerstone of building wealth, achieving financial freedom, and reducing stress about money. The good news is that you don’t need expensive tools to get started—there are several powerful free personal finance software options available today that help you track spending, budget smartly, set financial goals, and plan for the future.

Below is a curated list of top free personal finance software, along with insights into how they can help you unlock your financial potential.

Why Use Personal Finance Software?

- Centralized Tracking: Consolidate your bank accounts, credit cards, loans, and investments in one place.

- Budgeting: Easily create and maintain budgets aligned with your income and expenses.

- Goal Setting: Define savings goals such as emergency funds, vacations, or retirement.

- Spending Insights: Visualize where your money goes to identify and reduce unnecessary expenses.

- Financial Planning: Forecast cash flow, debt payoff, and investment growth.

Using personal finance software regularly builds financial awareness and discipline, crucial for wealth growth and financial independence.

Top Free Personal Finance Software Options

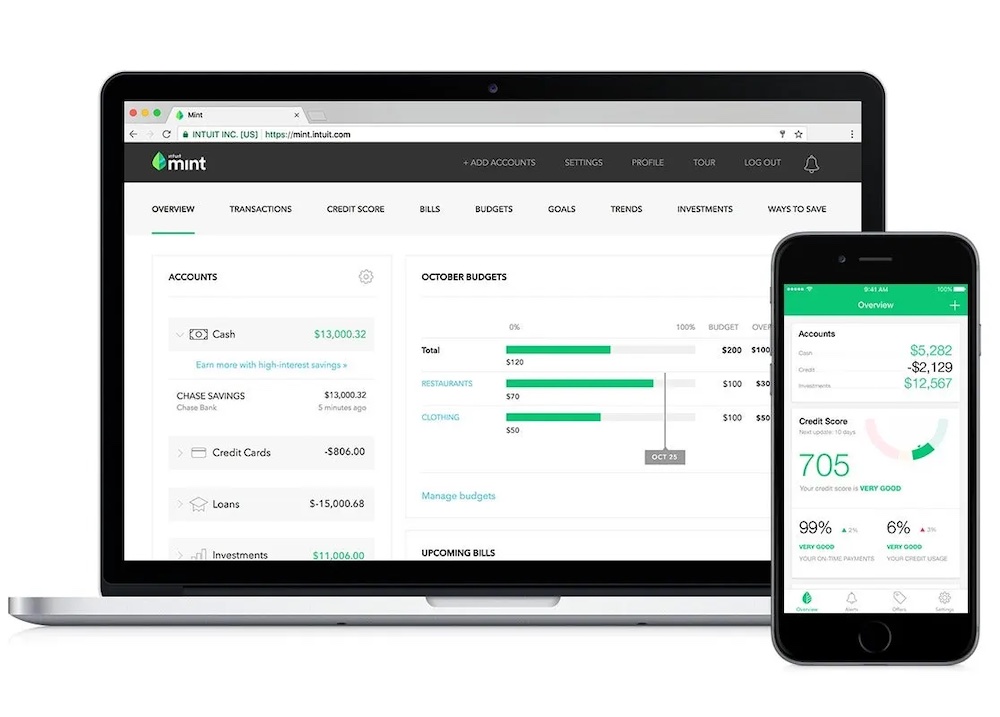

1. Mint

Mint, launched in 2006 and acquired by Intuit, has become a trusted free personal finance platform. It offers users a comprehensive view of their finances with automatic bank syncing for tracking transactions and balances. Mint has expanded to include credit score monitoring and bill reminders. Its user-friendly interface and data visualization tools cater to beginners aiming to manage spending and savings easily. The platform benefits from a large community and regular updates to stay competitive.

- Features:

- Connects to over 20,000 financial institutions for automatic transaction tracking.

- Budget creation with category-specific alerts.

- Bill tracking and reminders.

- Credit score monitoring.

- Investment tracking tools.

- Best for: Beginners and casual users who want an all-in-one financial overview.

- Platforms: Web, iOS, Android.

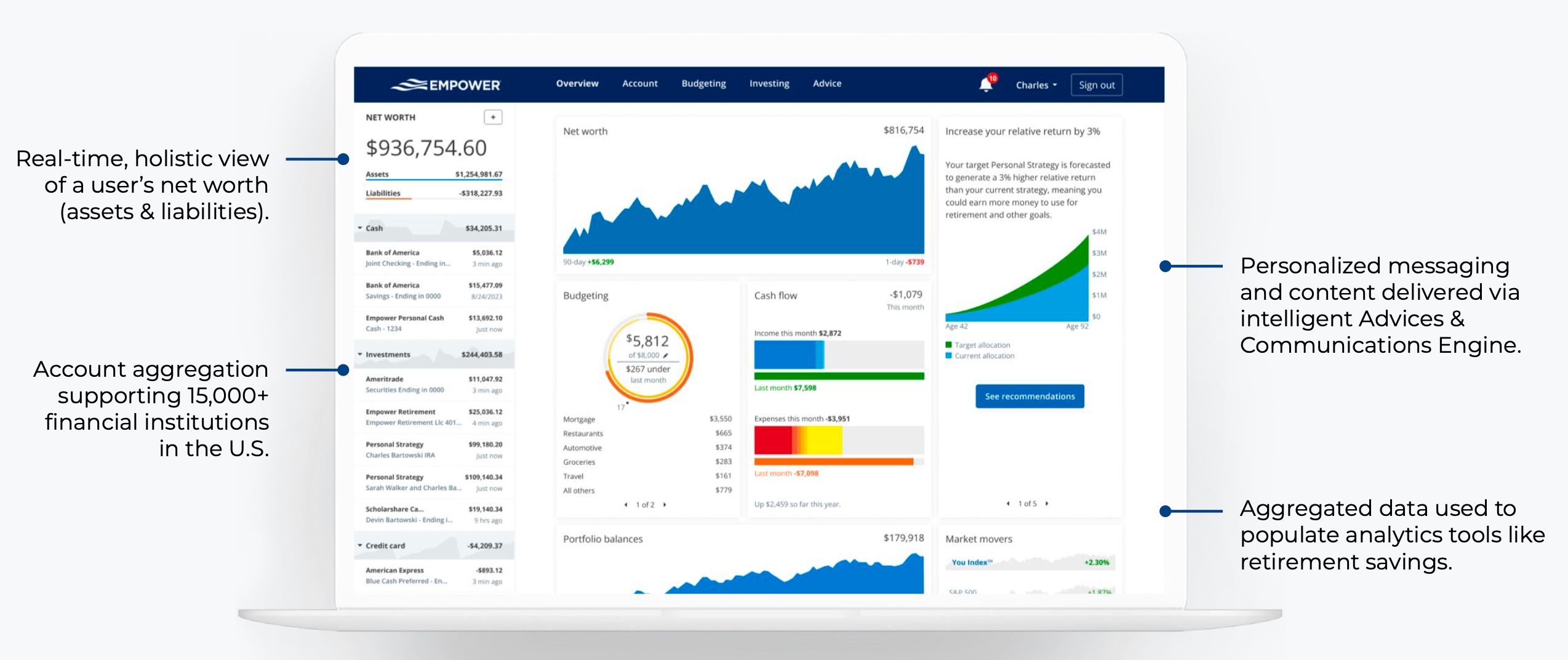

2. Empower Personal Dashboard (formerly Personal Capital)

Empower Personal Dashboard is a hybrid platform that combines budgeting tools with wealth management features, geared towards users seeking more than just expense tracking. Established in 2009, it offers a free financial dashboard along with premium services for personalized investment advice. Users can link investment accounts and assets to gain real-time insights into their net worth and investment performance. With tools such as retirement planners and fee analyzers, it appeals to investors and individuals focused on personal finance and long-term financial planning. Despite its advanced features, Empower Personal Dashboard remains user-friendly, merging complex analytics with clear visuals.

- Features:

- Detailed net worth tracking.

- Retirement planning calculator.

- Investment performance analysis.

- Expense tracking with budget features.

- Best for: Users who want strong investment tools alongside budgeting.

- Platforms: Web, iOS, Android.

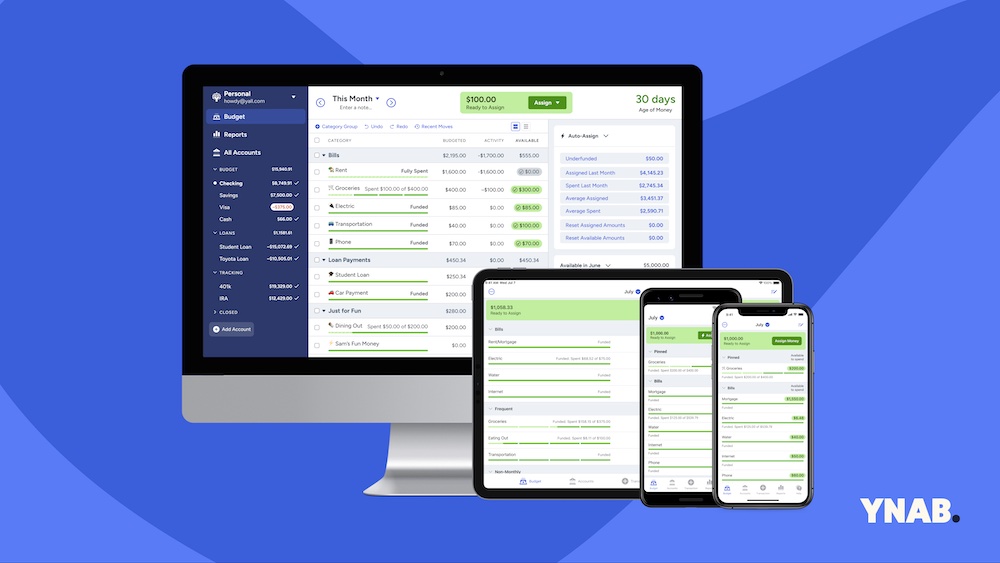

3. YNAB (You Need A Budget) – Free Trial

YNAB, launched in 2004, has gained a loyal following for its unique budgeting philosophy that gives every dollar a job. Though primarily a paid service, it offers a 34-day free trial, allowing users to explore its effective approach risk-free. YNAB promotes proactive budgeting to break the paycheck-to-paycheck cycle, using four core rules to help prioritize needs, curb overspending, and build savings. With a user-friendly interface, educational content, and a supportive community, YNAB stands out as a leading personal finance software for those committed to improving their financial habits.

- Features:

- Rule-based budgeting system focusing on giving every dollar a job.

- Real-time syncing across devices.

- Goal tracking and debt payoff tools.

- Educational resources to build budgeting skills.

- Best for: Users committed to a hands-on, zero-based budgeting approach.

- Platforms: Web, iOS, Android.

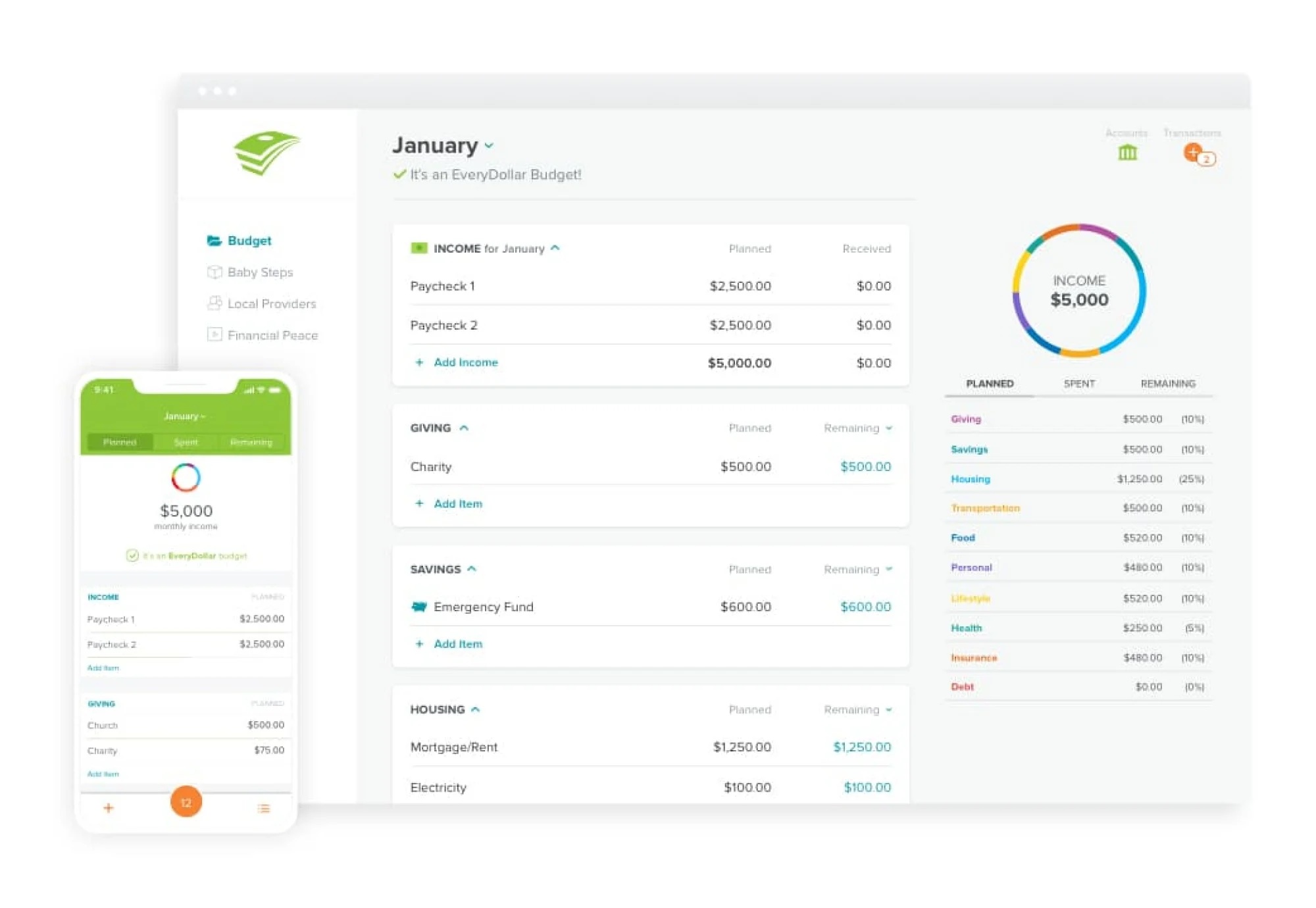

4. EveryDollar – Free Version

Created by financial expert Dave Ramsey, EveryDollar is a budgeting app based on his “Baby Steps” methodology, which focuses on debt reduction. The free version offers zero-based budgeting where users manually allocate income to categories. While it doesn't sync with banks, this method encourages users to stay engaged by entering transactions, promoting financial mindfulness. EveryDollar is ideal for Ramsey followers and those seeking a simple budgeting tool, supporting monthly planning with drag-and-drop features and goal tracking to help users manage debt and build emergency savings.

- Features:

- Simple drag-and-drop budget builder.

- Expense categorization.

- Manual transaction entry (bank sync in paid version).

- Best for: Fans of Ramsey’s financial philosophy or those who prefer manual control.

- Platforms: Web, iOS, Android.

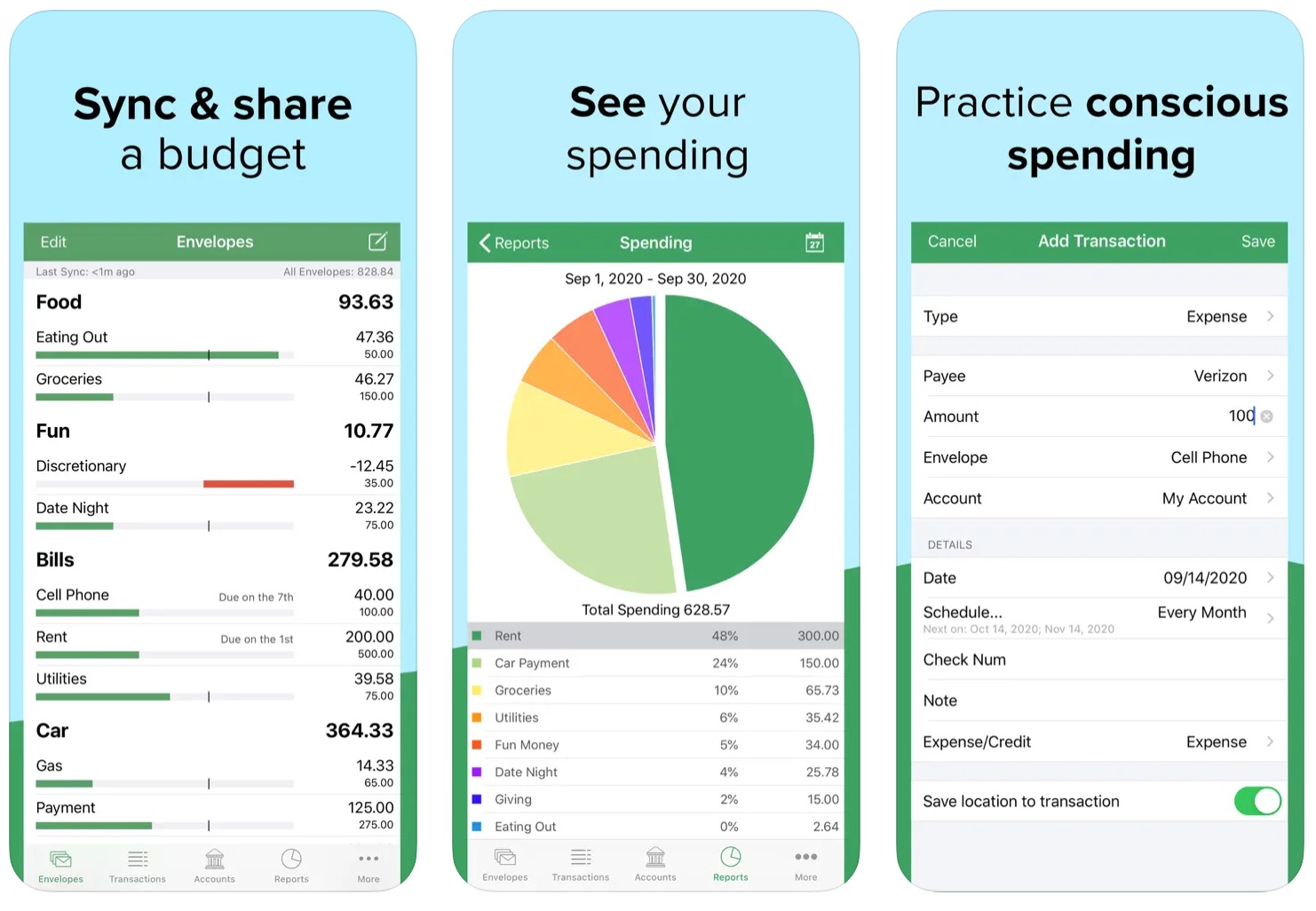

5. Goodbudget

Goodbudget is a modern envelope budgeting app that categorizes money for planned expenses. Launched in 2011, it helps users control spending through manual transaction entry, encouraging greater financial awareness. The app supports shared budgeting for couples and families, facilitating joint financial goals without complex investment tools. Its simplicity and collaborative features distinguish it from other budgeting apps.

- Features:

- Envelope-style budget categories.

- Syncs across devices.

- Debt tracking and savings goals.

- Best for: Users who prefer envelope budgeting and want to manage finances with a partner or family.

- Platforms: Web, iOS, Android.

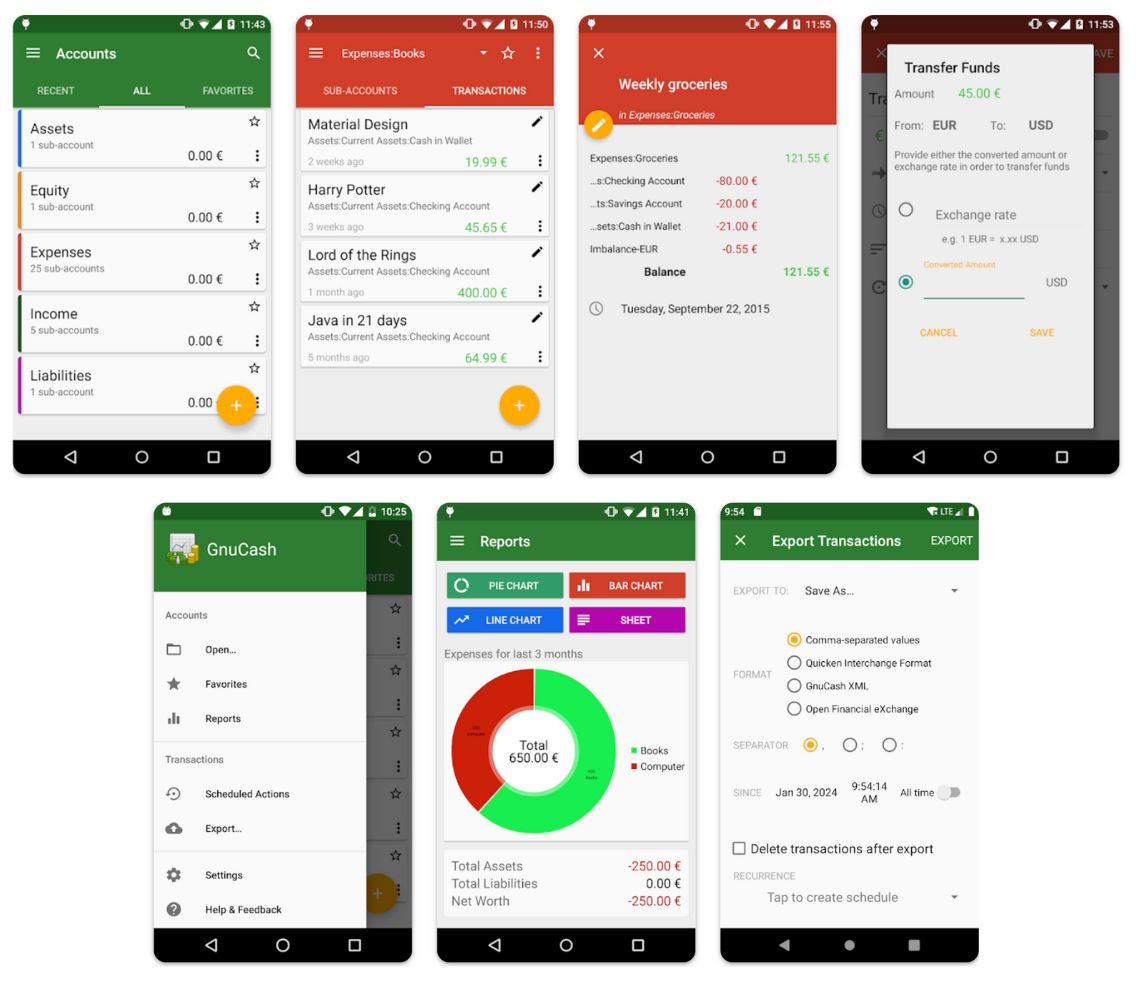

6. GnuCash

GnuCash is a free, open-source accounting software from the late 1990s, founded on double-entry bookkeeping. Unlike typical personal finance apps focused on ease and automation, GnuCash targets users familiar with accounting or seeking a customizable desktop solution. It helps track personal and small business finances, including bank accounts, stocks, income, and expenses, with features for recurring transactions and comprehensive reports. While it offers strong data privacy as a desktop application, it entails a steeper learning curve. It’s suited for those wanting powerful accounting without subscription fees.

- Features:

- Double-entry accounting.

- Scheduled transactions.

- Financial reports and graphs.

- Supports multiple currencies.

- Best for: Users comfortable with traditional accounting and desktop apps.

- Platforms: Windows, Mac, Linux.

How Free Software Unlocks Your Financial Potential

- Financial Clarity: Real-time access to spending and balances helps avoid overdrafts and impulsive purchases.

- Improved Budgeting: With alerts and visual data, you can adjust spending habits promptly.

- Goal Achievement: Set and track milestones for savings, debt repayment, or investments.

- Debt Management: Some apps offer tailored debt payoff plans and track progress.

- Investment Awareness: Monitor portfolio performance and fees to maximize returns.

- Empowerment: Gaining control of your money leads to confidence in financial decision-making.

Tips for Choosing the Right Personal Finance Software

- Ease of Use: Pick software that matches your tech comfort level.

- Security: Ensure strong encryption and data protection.

- Features: Prioritize what matters to you—budgeting, investment tracking, debt payoff.

- Automation vs. Manual: Decide if you want automatic bank syncing or prefer manual entry.

- Device Compatibility: Confirm the software works on your preferred devices.

Features Comparison

| Feature / Software | Mint | Personal Capital | YNAB (Free Trial) | EveryDollar (Free) | Goodbudget | GnuCash |

|---|---|---|---|---|---|---|

| Cost | Free | Free | 34-day free trial, then paid | Free (paid version available) | Free (paid version available) | Completely free, open-source |

| Platform | Web, iOS, Android | Web, iOS, Android | Web, iOS, Android | Web, iOS, Android | Web, iOS, Android | Desktop (Windows, Mac, Linux) |

| Bank Account Sync | Automatic, thousands of banks | Automatic, multiple accounts | Manual or automatic sync (paid) | Manual only (free version) | Manual only | Manual entry only |

| Budgeting Style | Traditional budgeting, category-based | Budget + investment focused | Zero-based budgeting (give every dollar a job) | Zero-based budgeting | Envelope budgeting | Traditional double-entry accounting |

| Investment Tracking | Basic | Advanced | No | No | No | No |

| Credit Score Monitoring | Yes | No | No | No | No | No |

| Bill Reminders | Yes | No | No | No | No | No |

| Debt Payoff Tools | Basic | Yes | Yes | Yes | Basic | No |

| Goal Setting & Tracking | Yes | Yes | Yes | Yes | Yes | Limited |

| User Collaboration | No | No | No | No | Yes (sync across devices) | No |

| Educational Resources | Moderate tutorials, blog | Strong financial planning tools | Extensive workshops, community | Limited | Limited | Limited |

| Privacy / Security | Encrypted, cloud-based | Encrypted, cloud-based | Encrypted, cloud-based | Encrypted, cloud-based | Encrypted, cloud-based | Local storage, user controls |

| Ideal For | Beginners wanting all-in-one | Investors & wealth planners | Hands-on budgeters ready to commit | Fans of Dave Ramsey’s method | Couples/families using envelope method | Users familiar with accounting, freelancers |

Summary:

- Mint is best for beginners who want a free, automatic, and comprehensive overview of their spending, budgeting, and credit health.

- Personal Capital shines if you want in-depth investment tracking alongside basic budgeting.

- YNAB is perfect for those who want to learn disciplined, zero-based budgeting but are okay with the short free trial before paying.

- EveryDollar’s free manual budgeting suits fans of Dave Ramsey’s approach and those who want to be hands-on.

- Goodbudget is great for couples or families who prefer envelope budgeting and shared control.

- GnuCash is best if you want a powerful, free desktop tool with full accounting capabilities and don’t mind manual input.

Final Thoughts

Unlocking your financial potential starts with understanding your money flows and setting clear goals. Free personal finance software provides accessible, user-friendly tools to build those habits and insights without the upfront cost. Whether you prefer automatic syncing like Mint or manual envelope budgeting with Goodbudget, the key is consistent use.

If you want a starting recommendation, Mint offers a comprehensive and easy-to-use platform for most beginners. For more advanced users focused on investments, Personal Capital is excellent.