Understanding XRP and Essential Cryptocurrency Terms

Understanding XRP and Essential Cryptocurrency Terms

With cryptocurrencies such as XRP and Bitcoin continuing to dominate the financial headlines, the cryptocurrency market has recently reached new heights. XRP, specifically, has gained considerable attention amid growing discussions around digital currencies. Here’s a simplified guide to cryptocurrency fundamentals, with a primary focus on XRP.

XRP

XRP, the cryptocurrency developed by Ripple Labs in 2012, operates on the XRP Ledger. XRP distinguishes itself from Bitcoin by offering faster transaction speeds and significantly lower costs. Using a consensus-based verification method rather than traditional mining, XRP enables multiple simultaneous transactions, making it highly efficient and attractive for cross-border payments and international transactions by financial institutions. However, XRP, like other cryptocurrencies, faces regulatory scrutiny and market volatility.

Bitcoin

Bitcoin, alongside XRP, is among the most recognized digital currencies. It operates independently of traditional financial institutions, offering decentralization. While Bitcoin reached a notable peak of $120,000 in July 2025, driven by supportive crypto policies, it remains highly volatile compared to more transaction-focused currencies like XRP.

Blockchain

Blockchain technology underlies cryptocurrencies, including XRP and Bitcoin. It functions as a secure, decentralized digital ledger that records and validates cryptocurrency transactions through a network of validators. Unlike XRP’s consensus approach, Bitcoin transactions are validated by miners, a method criticized for its extensive energy consumption.

Bitcoin Halving

Bitcoin halving events occur approximately every four years, decreasing miner rewards and limiting supply. While XRP has a fixed initial supply of 100 billion tokens, Bitcoin’s supply is capped at 21 million, driving periodic price spikes after halving events. The most recent halving occurred in April 2024, cutting Bitcoin miner rewards significantly.

Crypto Exchange

Crypto exchanges are online marketplaces where users can trade digital currencies like XRP and Bitcoin. These exchanges facilitate converting traditional currencies into cryptocurrencies, with fees varying depending on the platform.

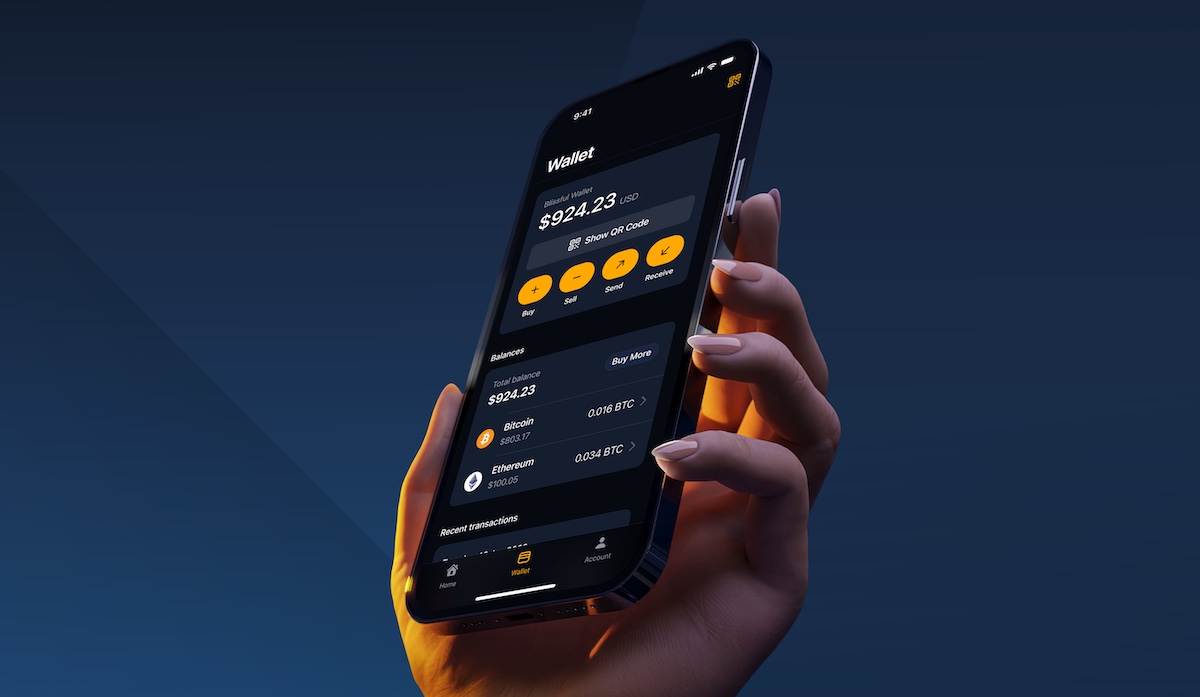

Crypto Wallet

Crypto wallets securely store cryptocurrencies, including XRP. Wallets come in two main types:

- Hot wallets: Connected to the internet, enabling quick transactions.

- Cold wallets: Offline devices for safe, long-term storage, especially useful for holding XRP securely.

Ethereum

Ethereum, second in market prominence after Bitcoin, is another key blockchain platform, supporting a range of decentralized applications and tokens. Unlike XRP, Ethereum recently switched to a greener proof-of-stake mechanism to minimize energy usage.

Exchange-Traded Funds (ETFs)

ETFs are investment funds traded on stock exchanges, including spot Bitcoin ETFs that allow investors indirect exposure to cryptocurrencies. While no direct XRP ETFs exist yet, increased crypto ETF approvals could pave the way for similar XRP-focused products, making investment in digital assets like XRP more accessible to traditional investors.

Meme Coins

Meme coins are speculative digital currencies tied to internet trends or memes, unlike XRP, which serves a clear, practical financial utility. Meme coins are notoriously risky due to their speculative nature, often experiencing significant value fluctuations.

Stablecoins

Stablecoins are cryptocurrencies pegged to traditional assets such as currencies or commodities. Their asset-backed nature aims to reduce volatility, contrasting with XRP's focus on rapid and low-cost international payments. However, stablecoin collapses have led to increased regulatory scrutiny.

Focusing on XRP helps investors appreciate its unique value within the broader cryptocurrency market. Understanding these foundational terms enhances clarity in navigating the complex and evolving crypto space.