Beef prices are soaring in the U.S. — and it's not just a summer trend

Beef prices are soaring in the U.S. — and it's not just a summer trend

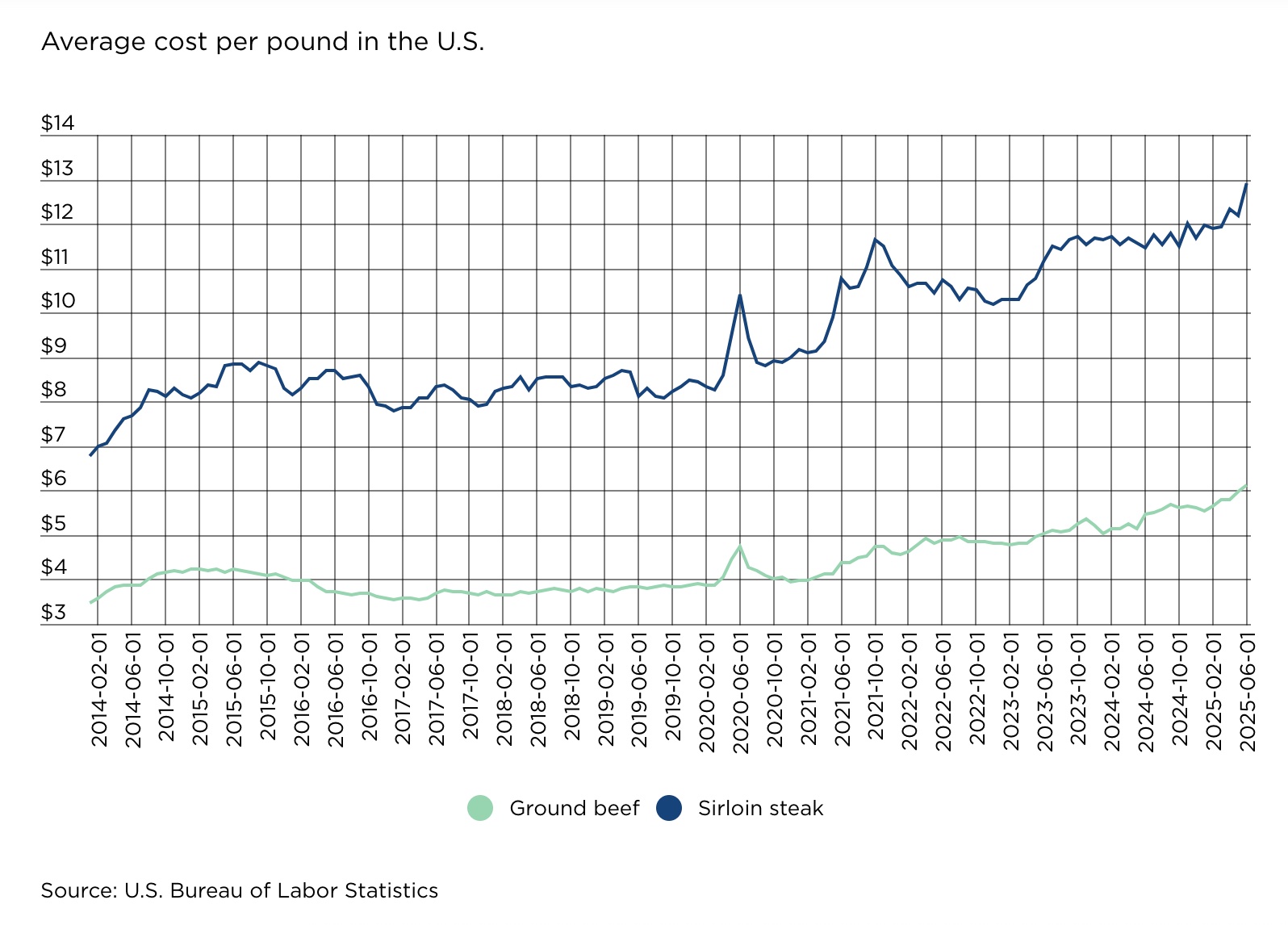

Beef prices in the U.S. have rocketed to new records, squeezing household budgets and challenging restaurateurs. This report unpacks every major driver behind the rise, from a 70-year-low cattle herd and weather-related feed costs to a screwworm-induced ban on Mexican cattle and looming 50% tariffs on Brazilian beef. You will find fresh data, expert insights, and actionable takeaways.

The 2025 Beef Price Snapshot

Retail Sticker Shock

| Month 2025 | Ground Beef: Average $/lb | Year-on-Year Change |

| January | 5.79 | +10.8% |

| February | 5.63 | +9.5% |

| March | 5.79 | +11.4% |

| April | 5.80 | +12.0% |

| May | 5.98 | +11.6% |

| June | 6.12 | +11.8% |

Source: St. Louis Fed

The all-fresh retail beef composite averaged $8.15/lb in January and has hovered above $8.25 for twelve consecutive months, the highest run on record.

Wholesale & Live-Cattle Signals

- Choice boxed-beef cutout hit $367.55/cwt in July, up 16.8% y/y.

- Live cattle futures trade near $2.30/lb, a record for midsummer.

- Feeder steer prices average $274.75/cwt in USDA’s latest outlook.

How Did We Get Here? A 20-Year Climb

A Shrinking Cattle Herd

| Year | All Cattle & Calves (million head) | % Change vs 2019 Peak |

| 2019 | 94.8 | Peak |

| 2020 | 93.0 | −1.9% |

| 2021 | 91.9 | −3.1% |

| 2022 | 89.3 | −5.8% |

| 2023 | 87.2 | −7.9% |

| 2024 | 87.2 | −7.9% |

| 2025 | 86.7 | −8.5% |

Source: Food Business News, American Farm Bureau Federation, The Western Producer, Clemson University, TradingView

At 86.7 million head, the national herd is the smallest since 1951. Years of drought and high feed costs forced ranchers to liquidate cows instead of retaining heifers for breeding.

Drought & Feed Costs

Persistent drought blanketed up to 72% of cattle country in 2024, curbing forage and raising hay prices. Although rainfall improved in early 2025, total hay stocks remain 14% below the five-year average, limiting rapid herd expansion.

Screwworm Crisis Halts Mexican Cattle

What Happened?

In May 2025 USDA suspended all live-cattle imports from Mexico because the flesh-eating New World screwworm advanced northward as far as Oaxaca and Veracruz. The border shutdown affects roughly 1 million feeder cattle per year—about 4% of U.S. slaughter supplies.

Supply Shock

- Feedlots in Texas, Arizona, and California are already 6–9% below normal head counts.

- Analysts warn that every two months of suspension trims domestic beef output by roughly 60 million lb, enough to supply 25 million quarter-pound burgers.

Tariff Turbulence: Brazil on the Hot Seat

The 50% Trump Tariff

On July 9 President Trump ordered a 50% tariff on all Brazilian imports effective August 1, raising the total duty on Brazilian beef to 76.4%. Brazil supplied 21% of U.S. beef imports in the first five months of 2025.

| Import Source Jan–May 2025 | Volume (000 mt) | Share |

| Brazil | 214.5 | 21% |

| Australia | 192.3 | 19% |

| Canada | 171.0 | 17% |

| Mexico | 142.7 | 14% |

| Others | 301.0 | 29% |

Brazilian exporters call the U.S. market “unviable” at the new rate and have begun redirecting cargoes to China.

Why Brazilian Lean Matters

Hamburger meat typically blends 70% fatty U.S. trim with 30% imported lean. Losing Brazilian trim tightens supply just as grilling season peaks, cushioning retail ground-beef prices above $6.00/lb.

Feed, Weather & Cost Pressures

Even with better pasture conditions, corn futures remain above $5.20/bu and alfalfa hay averages $220/ton, both 15–20% higher than pre-pandemic norms. Elevated inputs translate into record-high feeder-cattle bids and ultimately retail beef prices.

Demand Remains Resilient

Per-capita beef consumption held unexpectedly firm at 59.7 lb in 2024 and shows only a minor retreat for 2025 despite higher shelf prices. All-fresh beef still outsells pork and broiler meat by value, reflecting strong consumer loyalty.

When Will Prices Ease?

Herd Rebuilding Timeline

- Retention Phase: Ranchers must first stop cow liquidation. Early auction data show heifer retention ticked higher in June 2025.

- Breeding & Calving: A bred heifer produces her first calf 18–24 months later.

- Feedlot Finishing: That calf becomes beef roughly 20 months after birth.

Result: Even with aggressive retention, additional supplies cannot reach supermarkets before late 2027.

Possible Wild Cards

- Border Re-opening: Each month, the screwworm ban persists removes up to 80,000 feeder cattle from U.S. pipelines.

- Tariff Back-pedaling: Diplomatic compromise could restore some Brazilian trim and alleviate lean shortages.

- Demand Shift: Consumers may trade down to ground beef or switch proteins, but data so far show only modest substitution.

Consumer Strategies for 2025 Grilling

- Buy in bulk when on promotion: Warehouse clubs still run occasional loss-leader specials on 10-lb chubs.

- Explore value cuts: Chuck eye, sirloin flap, and Denver steak offer steakhouse flavor at a lower cost.

- Slow-cook tougher muscles: Bottom round flats, now declining in wholesale price, shine in sous-vide or braise.

- Blend proteins: Mixing 30% plant-based crumbles with 70% beef can cut burger cost without sacrificing texture.

Glossary

- Boxed Beef Cutout: USDA’s composite wholesale value for a carcass.

- CWT: Hundredweight (100 lb).

- Lean Trim: Low-fat beef is used to adjust fat content in ground products.

- Screwworm: Parasitic fly larva that feeds on live tissue.

Key Takeaways

- Supply Shock: The U.S. cattle herd is at a 70-year low, and live-cattle imports from Mexico are paused—tightening supplies further.

- Cost Pressures: Feed, fuel, and labor inflation keep production costs elevated.

- Trade Volatility: A 50% tariff threatens one-fifth of lean-beef imports from Brazil, intensifying ground-beef shortages.

- Consumer Impact: Retail ground beef now averages $6.12/lb, with USDA projecting another 6.8% increase for beef prices in 2025.

- Outlook: Meaningful price relief is unlikely before late 2027, barring a rapid herd rebuild or rollback of trade frictions.

Brace for a prolonged period of premium beef prices. Strategic shopping, alternative cuts, and diversified proteins can help families manage the beef budget squeeze while still enjoying America’s favorite grilling staple.